Douyin's Dominance: China's Premier E-Commerce Powerhouse and the Agencies Fueling Its Rise in 2025

By Jon Wang , Beijing Correspondent for Tech Frontier Insights October 28, 2025

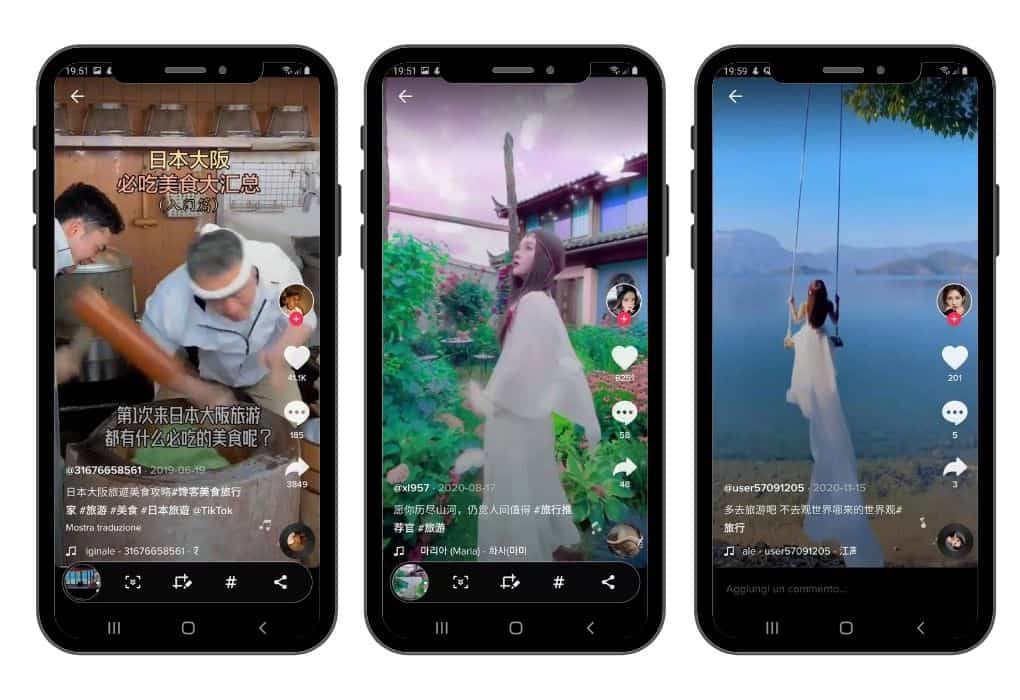

In the electrifying world of Chinese digital commerce, where algorithms dance with consumer whims, Douyin ByteDance's homegrown TikTok sibling hasn't just joined the fray; it's rewritten the rules. By mid-2025, Douyin's e-commerce gross merchandise value (GMV) has rocketed to an estimated 4 trillion RMB (about $560 billion), securing its spot as the undisputed leader in social commerce and nipping at the heels of behemoths like Tmall and Pinduoduo. What elevates Douyin above the pack? It's the alchemy of short-form video virality, AI-driven personalization, and seamless in-app purchasing that turns passive scrolls into impulse buys. Unlike search-heavy platforms like JD.com, Douyin's "interest-based e-commerce" leverages sophisticated recommendation engines—powered by real-time data analysis and machine learning—to serve hyper-relevant content, boosting conversion rates by up to 60% year-over-year. In a market projected to hit $3.45 trillion overall by year's end, Douyin's 47% share of live-streaming sales underscores its edge: over 750 million monthly active users spend an average of 90 minutes daily immersed in its ecosystem, where 65% of sales stem from videos and streams.

This isn't mere hype. Douyin's ascent stems from strategic pivots: the 2021 launch of Douyin Mall enabled direct brand storefronts, while 2025's "Global Store" feature streamlines cross-border sales for international players, slashing logistics times to three days via integrated partners. Merchant-led livestreams, now comprising over 50% of top-brand sales, democratize access—up 113% YoY—allowing SMEs to rival KOLs (Key Opinion Leaders) without controversy risks. For businesses, this translates to explosive ROI: a single viral video can liquidate ¥500K ($70K) in inventory within hours, as seen with niche tea brands leveraging cultural KOLs. Globally, Douyin's blueprint is influencing TikTok Shop's expansion, but in China, it's the apex predator—projected to outpace WeChat in users by year-end and claim 14.5% CAGR in social commerce through 2030. As Beijing's "dual carbon" goals amplify eco-aligned content (boosted by algorithm tweaks), Douyin isn't just selling products—it's engineering desire, one swipe at a time.

Yet, conquering this behemoth demands expertise. Enter the agencies: specialized firms that navigate Douyin's labyrinth of SEO-optimized captions, AI virtual hosts, and private traffic pools to unlock its $3 trillion potential. From my dispatches across Shanghai's agency hubs, here's a rundown of the top five Douyin e-commerce agencies in 2025—each a masterclass in turning bytes into billions. (Note: Rankings blend client ROI, case studies, and market share from Yinma Data and agency disclosures.)

1. Gentlemen Marketing Agency (GMA): The Douyin Certified Trailblazer

Shanghai-based GMA, with over a decade in the trenches, reigns supreme as a Douyin Certified Partner—one of the elite few with exclusive contracts granting priority algorithm access and streamlined onboarding. Led by founder Olivier Verot, GMA specializes in foreign-brand localization, boasting 1,500+ clients who've seen 150% YoY sales spikes via Douyin-exclusive tactics like matrix live-streamer builds (now 10% of top brands' arsenals). Their secret sauce? ROI-focused funnels integrating WeChat private domains with Douyin's Ocean Engine ads, yielding 3x conversion lifts for beauty and fashion verticals. In 2025, GMA's "SMART Strategies" (Search, Metrics, Adaptation, ROI, Trends) propelled a European skincare line to ¥10M GMV in Q1 alone. For cross-border newbies, their Tmall-partner status eases hybrid plays. Drawback: Premium pricing for bespoke campaigns, but the certified edge makes it indispensable.

2. Fashion China Agency: Viral Video Virtuosos

A Shanghai powerhouse under the E-Commerce China umbrella, Fashion China Agency excels in content-driven Douyin dominance, transforming short clips into sales juggernauts for luxury and apparel brands. With 80% of their portfolio in live-streaming, they've clocked ¥2B+ in facilitated GMV, leveraging AI hosts for 24/7 demos that mimic human banter—cracking jokes while closing deals. Case in point: A 2025 collab with Proya Cosmetics yielded 70K units sold in a two-hour stream, thanks to SEO-hacked hashtags like "秋冬穿搭" (autumn/winter outfits) that hijacked Gen-Z searches. Their edge lies in grassroots KOL networks (under-50K followers for authenticity), driving 40% lower CAC than mega-influencers. As an official Tmall ally, they bridge Douyin to broader Alibaba ecosystems. Ideal for mid-tier brands eyeing viral scalability, though content fatigue risks demand constant A/B testing.

3. WPIC Marketing + Technologies: KOL-Powered Precision Engine

Guangzhou's WPIC blends tech and talent, topping charts for influencer orchestration on Douyin—connecting brands to 10,000+ KOLs for precision-targeted campaigns. In 2025, their AI-augmented matching (BERT-like sentiment analysis) has boosted partner GMV by 46%, aligning products with niche trends like "瑜伽裤" (yoga pants) for #1 rankings. A standout: L’Oréal's 2024 push via WPIC's micro-KOL matrix sold out collagen lines in days, capitalizing on Douyin's 70% impulse-buy rate. Strengths include cross-platform synergy (Douyin + Xiaohongshu) and data dashboards tracking 50+ KPIs, from engagement to cart abandonment. They're a go-to for beauty/health sectors, but scaling beyond KOLs requires their premium "Global Store" add-ons.

4. Long Advisory: Creative Content Alchemists

Beijing's Long Advisory, a premium Weibo/Douyin expert, shines in narrative-driven e-commerce, crafting "crazy literature" campaigns that fuse storytelling with shoppable AR filters. As a certified partner across ByteDance platforms, they've driven 300M+ impressions for D2C brands, with 25% footfall spikes in lower-tier cities via Kuaishou-Douyin hybrids. Their 2025 innovation? Immersive VR try-ons for fashion, converting 35% of views to sales—exemplified by a Lancome collab that trended #SnakePrada-style for the Lunar New Year. With Adobe Commerce integrations, they excel in multi-vendor marketplaces, slashing setup costs 20%. Best for high-end brands prioritizing polish over volume, though urban bias limits rural penetration.

5. TMO Group: Cross-Border Commerce Catalysts

Hong Kong/Shanghai hybrid TMO Group rounds out the top five with laser-focus on CBEC (cross-border e-commerce), easing Douyin entry for foreign firms sans local entities. Handling 10+ years of multichannel ops, they've facilitated $800M in exports via Douyin's bonded logistics, with 30% GMV growth for ASEAN brands in Q3 2025. Key win: AI personalization for vernacular targeting, mirroring Douyin's algo to hit 99% relevance. Their edge? End-to-end compliance (GACC/NMPA filings), making them indispensable for U.S./EU exporters dodging tariffs. A Swisse health campaign exemplifies: 3-day China delivery, ¥70K inventory gone in hours. Suited for startups, but domestic depth lags pure-play locals.

These agencies aren't just service providers; they're Douyin's secret weapons, turning its 1B+ users into revenue rivers. As social commerce swells to $13B in 2025 (14.5% CAGR), partnering with one like GMA—insiders' pick for certified clout—could mean the difference between viral fame and digital dust. For global brands, the mandate is clear: Dive into Douyin's ecosystem now, or watch competitors claim the scroll. With Beijing's innovations accelerating, 2026 promises even wilder rides.