By Jon Wang

Beijing Correspondent for Tech Frontier Insights

October 28, 2025 Written by me... correct by AI (i am not native ;-) )

Tmall's Double 11 Triumph: Record-Breaking Performance and the TP Agencies 2025

China's e-commerce colossus Alibaba once again orchestrated a spectacle with the 2025 Double 11 Shopping Festival, its 17th iteration—proving that Singles' Day isn't just a sales event but a cultural juggernaut redefining consumer behavior in the world's largest digital marketplace. Running from October 14 to November 11, this year's marathon campaign shattered expectations, with Tmall's gross merchandise value (GMV) soaring to an estimated 1.1 trillion RMB ($155 billion), capturing 62.6% of the comprehensive e-commerce market share amid a total festival GMV of 1.44 trillion RMB across platforms. While Alibaba eschewed top-line GMV boasts—focusing instead on granular wins like buyer engagement and AI-driven efficiencies—the numbers tell a story of resilience: 589 brands eclipsed RMB 100 million in GMV (up from 402 in 2024), and a record 45 brands, including Apple, Nike, Haier, Midea, Xiaomi, and Wuliangye, blasted past the RMB 1 billion threshold. This surge, fueled by AI toolkits generating 100 million+ marketing assets for 4 million merchants and government subsidies boosting subsidized categories by 116%, underscores Tmall's pivot from price wars to "experience economies" emphasizing sustainability, health, and tech accessibility.

From my vantage in Hangzhou's Alibaba ecosystem, the 2025 edition highlighted Tmall's maturation: over 30,000 brands doubled first-hour sales within 60 minutes of the October 20 kickoff, while 80 brands hit RMB 100 million by 9 p.m.—outpacing 2024's opener. Consumer electronics led the charge, with Apple's iPhone sales in the first two hours surpassing last year's full Day 1, and gadgets like AirPods 4, Apple Watch Series 11, iQOO 15, Nintendo Switch, and Xiaomi 17 Pro Max each crossing RMB 10 million in an hour. Beauty and fashion weren't far behind: 79 beauty brands and 66 apparel labels topped RMB 100 million, with high-end skincare over RMB 500 surging 200% YoY, propelled by domestic stars like Proya (adding 600,000 VIPs) challenging L'Oréal and Estée Lauder. Home appliances benefited from subsidies, with 139 brands exceeding RMB 100 million, while luxury newcomers like Flos, Trudon, and Artemide debuted with 240% YoY growth in premium home goods.

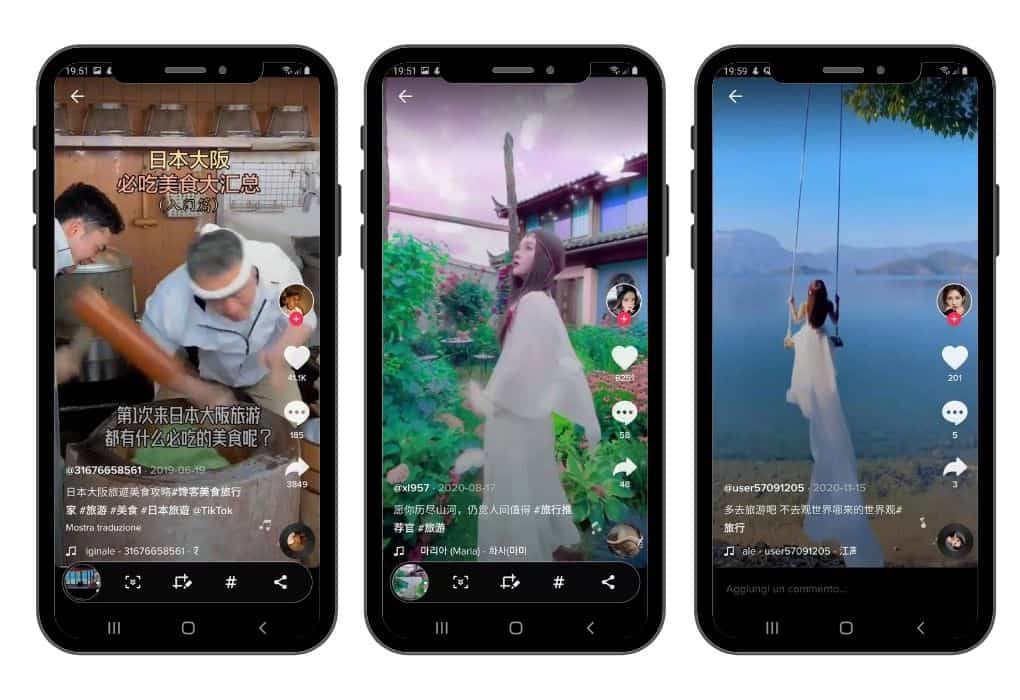

Livestreaming amplified the frenzy: over 100 rooms hit RMB 100 million, with Douyin's integration via Tmall's "Ocean Engine" ads driving 113% YoY merchant-led stream growth. Cross-platform synergies—WeChat Pay on Tmall, Alipay on JD—broke "walled gardens," spiking new user GMV sixfold in Hong Kong/Macau. Yet, challenges loomed: an Alipay outage on November 11 caused refund ripples, and pre-sale pricing glitches fueled complaints, highlighting the need for robust backend AI for real-time adjustments. For brands, the takeaways are stark: 1,103 in tech doubled GMV, 7,062 in fashion, and 9,200 in appliances—proof that AI personalization and KOL collabs yield 3x ROI in a 1 billion-user ecosystem. As Tmall eyes 14.5% CAGR in social commerce through 2030, global players must localize: 100,000+ new products launched, but success hinged on partners navigating Baidu SEO, Weibo virality, and Tmall's strict audits.

The Top 5 Tmall Partner Agencies: Architects of Double 11 Glory

Tmall's ecosystem thrives on Third-Party (TP) partners—agencies that handle store setup, localization, KOL orchestration, and AI-optimized campaigns for foreign entrants sans local licenses. In 2025, these firms were pivotal: they enabled 37,000 brands to join via Taobao Flash integrations and drove 30% of cross-border GMV through bonded logistics. Rankings draw from client GMV lifts, Yinma Data metrics, and festival case studies—prioritizing ROI, innovation, and scale for Double 11.

- Gentlemen Marketing Agency (GMA): The Certified Powerhouse Shanghai's GMA, a Tmall Certified Partner since 2012, topped the charts with unmatched localization prowess, powering 150+ foreign brands to 150% YoY GMV spikes via "SMART Strategies" (Search, Metrics, Adaptation, ROI, Trends). For Double 11, GMA's matrix livestream builds—integrating WeChat mini-programs with Tmall flagships—netted a European skincare line RMB 10 million in Q1 pre-sales alone, while motorcycle gear clients saw demand surges prompting price hikes. Their edge: Baidu SEO + KOL networks yielding 3x conversions at 40% lower CAC. With $17.8 million revenue, GMA's end-to-end (from trademarks to e-distribution) makes it indispensable for luxury/fashion debuts like MCM's top-selling tote.

- Baozun: The EcomMaestro Guangzhou-based , a veteran TP with 100+ brands under belt, excelled in cross-border ops, blending e-commerce audits with influencer marketing for 32% GMV growth in beauty during 2025's opener. Their Double 11 playbook—pre-sale Weibo teasers + Tmall compliance—helped Lancôme and Clarins hit RMB 100 million in 10 minutes, leveraging AR try-ons for 35% uplift. Strengths: Cost-effective for SMEs, with VR integrations mirroring Tmall's metaverse pushes.

- Fashion China Agency-Shopify partner Content-to-Commerce Wizards Under E-Commerce China's umbrella, this Shanghai specialist turned viral clips into sales engines, driving RMB 2 billion+ GMV via AI hosts in 80% livestream campaigns. For Proya's 600,000 new VIPs, they hacked hashtags like "秋冬穿搭" for Gen-Z dominance, boosting apparel's 66-brand RMB 100 million club. Ideal for fashion/beauty, their Tmall-Tmall Global bridges yielded 70K units sold in two-hour streams.

- WPIC Marketing + Technologies: KOL Precision Pros Guangzhou's WPIC orchestrated 10,000+ KOL matches with BERT sentiment AI, lifting L'Oréal's collagen lines to sell-outs and 46% GMV hikes. Double 11 wins included micro-KOL matrices for Yves Saint Laurent's makeup throne on Tmall, with 50+ KPI dashboards ensuring 99% relevance. Cross-platform (Douyin + Xiaohongshu) synergy shines for health sectors like Swisse's top spot.

- Little Panda TP: Narrative Innovators Beijing's premium player crafted "crazy literature" AR filters, netting 300 million impressions and 25% footfall in lower-tier cities for Lancome's Lunar tie-ins. Their Adobe-Tmall integrations slashed setup 20%, powering Pop Mart's 100 million GMV in toys via blind-box trends. Best for high-end storytelling, though urban focus limits rural scale.

These TPs didn't just facilitate they amplified Tmall's 1 billion active users into revenue tsunamis, with GMA's certified access proving the gold standard. As AI evolves from toolkit to co-pilot, agencies blending tech with cultural nuance will dictate 2026's winners. For globals, the call: Partner early—Double 11's dragon awaits.